The global print-on-demand industry reached $10.2 billion in 2024 and continues expanding at an impressive annual growth rate. This explosive growth reflects a fundamental shift in how entrepreneurs approach e-commerce, eliminating traditional barriers like inventory investment and storage costs.

Print on demand represents more than just a printing technology—it's a complete business model that enables anyone to start selling custom products without the financial risks associated with traditional retail. Whether you're an artist seeking to monetize your creativity or an entrepreneur exploring new revenue streams, understanding how this demand print system works can unlock significant opportunities.

In this comprehensive guide, you'll discover everything needed to leverage print-on-demand, from selecting the right print provider to implementing proven marketing strategies that generate consistent sales.

What Is Print on Demand?

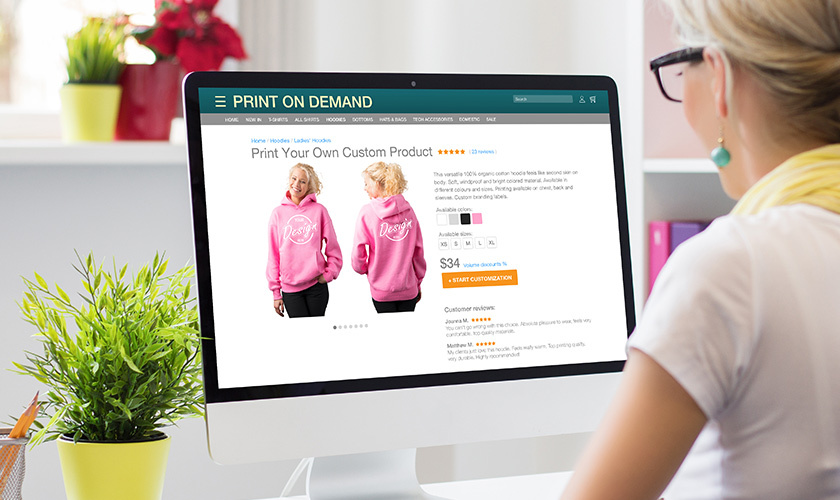

Print-on-demand (POD) is a business model in which products are manufactured only after customers place orders, eliminating the need for inventory or storage space. Instead of purchasing products upfront, sellers create designs and partner with a print-on-demand provider who handles manufacturing, packaging, and shipping directly to customers.

The print-on-demand model operates on a simple principle. When a customer buys a product from your online store, the order is automatically sent to your POD provider, which then creates the item according to your design specifications. This demand service ensures you never produce unsold inventory while maintaining the ability to offer hundreds of product variations.

Unlike traditional retail, which requires substantial upfront costs and inventory management, print-on-demand works by leveraging third-party fulfillment networks. Your print-on-demand partner maintains blank inventory and printing equipment, while you focus on creating designs and marketing to your target audience. This division of responsibilities allows entrepreneurs to launch profitable businesses with minimal upfront investment.

The technology underlying print-on-demand services has evolved dramatically, enabling high-quality products that compete directly with traditionally manufactured items. Modern print service providers use advanced digital printing methods to produce everything from custom T-shirts to wall art with professional-grade results.

How Print on Demand Works

The print-on-demand process follows a streamlined six-step workflow designed for efficiency and automation. Understanding how demand works helps entrepreneurs optimize their operations and set realistic customer expectations.

Step-by-Step POD Process

The journey begins when you create original designs using professional graphic design tools or AI-powered platforms. These designs must meet specific technical requirements, typically a 300 DPI resolution in EPS, PDF, SVG, or PNG format, to ensure optimal print quality across different product types.

Next, you upload designs to your chosen POD platform and select products from their catalog. Most platforms offer extensive product offerings, ranging from apparel to home décor. During this stage, you'll also set your retail price, determining profit margins based on the provider's base costs and shipping costs.

Setting up your online store represents the third crucial step. Whether using Shopify, Etsy, or a standalone e-commerce platform, integration with your POD provider enables automatic order processing. Modern e-commerce stores can seamlessly connect with multiple print-on-demand platforms simultaneously.

When a customer places an order through your storefront, the magic of automation takes over. Order details instantly transfer to your fulfillment partner, including design specifications, product selections, and shipping information. This seamless integration eliminates manual processing while maintaining accuracy.

Your print-on-demand provider then manufactures the product using digital printing technologies such as direct-to-garment (DTG) or direct-to-film (DTF). The printing process typically completes within 24-48 hours, depending on product complexity and queue volume.

Finally, the provider packages and ships the finished product directly to your customer using your branding materials. Most POD services offer white-label packaging, ensuring customers receive professional-looking packages that reflect your brand identity rather than the fulfillment company.

Print on Demand Products You Can Sell

The print-on-demand industry offers hundreds of customizable product categories, providing entrepreneurs with extensive opportunities to serve diverse market segments. Product selection significantly impacts profit margins, target-market appeal, and the effectiveness of marketing strategy.

Apparel and Accessories

T-shirts remain the most popular print-on-demand products, accounting for a large portion of the total market share. Their universal appeal, reasonable production costs, and high customization potential make them ideal for beginners. Basic tees typically yield $5-10 in profit per sale, while premium materials can yield $15-20 in margins.

Hoodies and sweatshirts offer higher profit potential, often generating $15-25 per sale due to their premium positioning and seasonal demand. These products particularly appeal to younger demographics and perform well during the fall and winter months.

The accessories category continues expanding rapidly, with bags, hats, and jewelry experiencing significant growth. These items often target specific niches or communities, enabling precise audience segmentation and premium pricing strategies.

Home and Office Products

Custom mugs, water bottles, and tumblers generate consistent year-round sales, appealing to corporate clients, gift-givers, and personal use customers. These products typically offer moderate profit margins while maintaining broad market appeal.

Wall art represents a high-margin category, with canvas prints and posters appealing to interior decoration enthusiasts. Success in this category often depends on artistic quality and trend awareness, making it suitable for creatively inclined entrepreneurs.

Journals, planners, and stationery products serve the productivity and organization market segment. These items often feature motivational quotes or specialized layouts, targeting clearly defined audiences with specific interests or professions.

Phone cases and tech accessories are experiencing annual growth as technology adoption continues to increase. These products combine functionality with personal expression, creating strong customer attachment and potential for repeat purchases.

Pros and Cons of Print on Demand

Understanding the advantages and limitations of the print-on-demand business model enables informed decision-making and realistic expectation setting. Like any business model, POD presents both opportunities and challenges that entrepreneurs must carefully consider.

Advantages

The most compelling advantage involves zero inventory investment. Entrepreneurs can start a print-on-demand business with small budgets, primarily allocated to design creation and initial marketing efforts. This low barrier to entry democratizes entrepreneurship, enabling individuals without significant capital to launch viable businesses.

Print-on-demand services eliminate the complexities of storage and warehouse management. Your POD partner handles all physical inventory, from blank products to finished goods, freeing you to focus on creative and marketing activities. This operational simplicity particularly benefits entrepreneurs operating from home or small office spaces.

The ability to test multiple product designs with minimal financial risk represents another significant advantage. Traditional retail requires substantial inventory commitments before gauging market demand, whereas print-on-demand allows rapid iteration and market testing. If a design doesn't work well, you can simply upload new concepts without incurring any financial loss.

Global shipping capabilities through provider networks enable international market access without complex logistics management. Many print-on-demand companies maintain fulfillment centers across multiple continents, ensuring reasonable shipping costs and delivery times for worldwide customers.

The potential for passive income attracts many entrepreneurs to this business model. Once systems are established and products are selling, print-on-demand can generate revenue with minimal daily involvement, though successful businesses still require ongoing marketing efforts and customer service.

Disadvantages

Lower profit margins represent the primary disadvantage, typically ranging from 10% to 30% compared to bulk manufacturing's margins. This limitation stems from the higher per-unit costs inherent in small-batch production, which make price competitiveness challenging in saturated markets.

Limited control over printing quality and shipping timeframes creates a dependency on third-party providers to ensure customer satisfaction. While reputable providers maintain high standards, quality inconsistencies can damage your brand reputation, even when you lack direct control over production processes.

The dependence on POD service providers creates business vulnerability. Changes in pricing, service quality, or provider availability can significantly impact your operations. Successful entrepreneurs often work with multiple providers to mitigate this risk.

Product variety restrictions limit offerings to provider catalogs, potentially constraining creative vision or market opportunities. While most platforms offer extensive selections, unique product ideas may require finding specialized providers or alternative fulfillment solutions.

Higher per-unit production costs make price competition difficult, particularly against established brands with economies of scale. Success often requires focusing on unique designs, superior customer service, or specialized market niches rather than competing solely on price.

Popular Print on Demand Platforms and Services

Selecting the right print provider significantly impacts business success, affecting everything from product quality to profit margins and customer satisfaction. The industry offers diverse options, from comprehensive fulfillment services to marketplace platforms with built-in audiences.

Fulfillment Services vs. Marketplaces

Fulfillment services like Printful, Printify, and Gooten require entrepreneurs to establish their own e-commerce store but offer higher profit margins and complete brand control. These print-on-demand providers integrate with popular platforms like Shopify, WooCommerce, and Etsy, enabling seamless order processing and inventory management.

Printful stands out for premium quality and extensive integrations, though their pricing tends toward the higher end. Their strength lies in product quality, consistency, and reliable customer service, making them popular among entrepreneurs prioritizing brand reputation.

Printify is the largest provider network, enabling competitive pricing through multiple supplier options. Their platform allows entrepreneurs to compare prices and quality across different fulfillment partners, optimizing margins for specific products.

Marketplace platforms like Redbubble, Society6, and Teespring provide built-in customer bases but offer lower profit margins and limited brand control. These platforms handle marketing and customer acquisition but retain significant revenue shares, typically leaving sellers with 10-20% margins.

The choice between fulfillment services and marketplaces depends on business goals and resources. Entrepreneurs seeking maximum control and profit potential typically prefer fulfillment services, while those prioritizing ease of entry often begin with marketplace platforms before transitioning to independent stores.

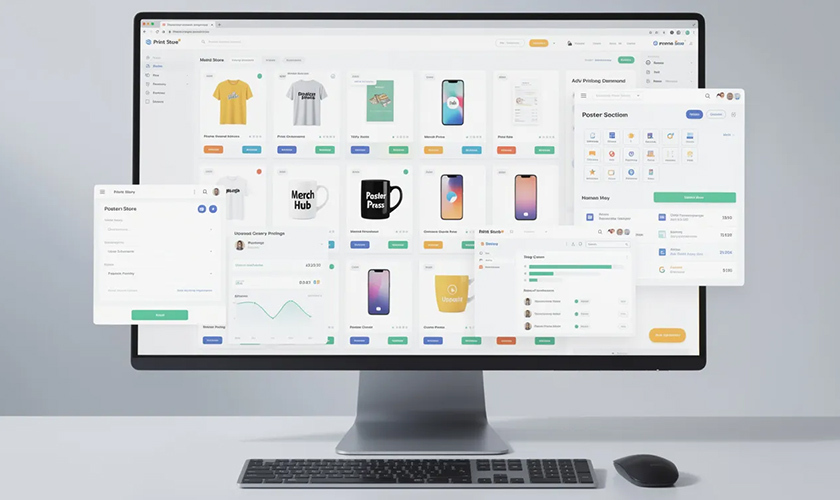

Integration capabilities are crucial considerations when selecting a print-on-demand platform. The best print-on-demand providers offer comprehensive APIs and plugins for popular e-commerce platforms, enabling automated order processing, inventory synchronization, and tracking updates.

How to Start a Print on Demand Business

Launching a successful print-on-demand business requires strategic planning, market research, and systematic implementation. The following guide provides actionable steps for beginners, with realistic timelines and budget considerations for the first 90 days of operation.

Choose Your Niche and Target Audience

Market research forms the foundation of successful POD businesses. Begin by identifying trending topics using Google Trends, Pinterest, and TikTok to understand current consumer interests. Look for patterns in viral content, emerging subcultures, and seasonal trends that could translate into product demand.

Focus on underserved communities and passionate hobbyist groups who actively seek specialized products. These audiences often pay premium prices for items that reflect their interests or identities. Examples include specific sports teams, professional associations, or niche hobbies with dedicated followings.

Analyze competitor pricing and design styles within your chosen niche to understand market positioning and identify gaps. Use tools like SimilarWeb or SEMrush to research competitor traffic and marketing strategies, gaining insights into successful approaches.

Validate demand through social media engagement and keyword research before committing resources. Create test posts on relevant platforms to gauge audience interest, and use keyword research tools to confirm search volume for related terms.

Create Winning Designs

Design quality directly impacts sales success and customer satisfaction. Professional designs require 300 DPI resolution to ensure crisp printing across all product types. Most providers specify file format requirements, typically accepting EPS, PNG, PDF, or SVG files with transparent backgrounds.

Leverage AI design tools like Midjourney, DALL-E, or Canva's features for inspiration and rapid iteration. These platforms enable entrepreneurs without extensive design experience to create professional-quality graphics, though understanding design principles remains important.

Consider hiring freelance designers on platforms like Fiverr or 99designs for complex projects or ongoing design needs. Professional designers bring expertise in color theory, typography, and market trends that can significantly impact sales performance.

Test design concepts through social media polls or focus groups before investing in product creation. This validation process helps identify winning concepts while avoiding designs with limited market appeal.

Maintain design files organized in cloud storage with clear naming conventions and version control. Proper file management becomes crucial as your product catalog grows and you work with multiple providers or team members.

Set Up Your Online Store

Platform selection impacts long-term scalability, costs, and functionality. Shopify offers comprehensive e-commerce features and extensive print-on-demand integrations, making it popular among serious entrepreneurs. Etsy charges per listing plus transaction fees, but provides built-in traffic and buyer trust.

WooCommerce provides free, self-hosted solutions with complete customization control, but requires technical knowledge for setup and maintenance. Consider your technical skills, budget, and growth plans when choosing platforms.

Install POD apps and configure automatic order processing to eliminate manual work. Most platforms offer official apps from major providers, ensuring reliable integration and regular updates.

Create compelling product descriptions incorporating relevant keywords for search engine optimization. Focus on benefits rather than features, helping customers visualize how products enhance their lives or express their personalities.

Use the high-quality mockup generators provided by your print-on-demand platform to showcase products professionally. These tools create realistic product images without requiring physical samples, enabling impressive storefront presentations.

Print on Demand Success Tips

Successful POD businesses combine quality products with effective marketing and excellent customer service. The following strategies come from successful entrepreneurs who earn monthly through the systematic application of proven tactics.

Marketing Your POD Products

Visual platforms like Instagram and Pinterest drive significant traffic for print-on-demand products due to their emphasis on imagery and discovery. Create consistent brand aesthetics across platforms by using cohesive color schemes and design styles that reflect your target market's references.

TikTok content showing products in use or design creation processes performs particularly well, leveraging the platform's emphasis on authentic, behind-the-scenes content. Many entrepreneurs share their design process, customer reactions, or product styling tips to build engaged audiences.

Email marketing remains highly effective for repeat sales and customer retention. Build email lists by offering design previews, exclusive discounts, or free digital downloads related to your niche. Regular newsletters featuring new products and styling inspiration keep your brand top-of-mind.

Partner with micro-influencers in your niche for authentic product promotion. Micro-influencers often have higher engagement rates and more targeted audiences than major celebrities, making them cost-effective partners for small businesses.

Allocate a decent percentage of revenue to paid advertising on Facebook, Google, and Pinterest. These platforms offer sophisticated targeting options that enable you to reach specific demographics, interests, and behaviors relevant to your products.

Quality Control and Customer Service

Order product samples before selling to customers to understand print quality, material feel, and sizing accuracy. This firsthand experience helps set appropriate customer expectations and identify potential issues before they affect sales.

Set clear expectations for printing and shipping timeframes in product descriptions and during checkout. Transparency about delivery times reduces customer frustration and support inquiries while building trust.

Respond to customer inquiries within 24 hours to maintain positive relationships and address concerns promptly. Quick response times often distinguish small businesses from larger competitors, creating competitive advantages through superior service.

Offer hassle-free returns and exchanges for legitimate quality issues to build customer confidence. While returns cut into profits, generous policies often increase conversion rates and customer lifetime value.

Monitor your POD provider's performance regularly and be prepared to switch if quality declines. Track customer complaints, return rates, and product quality to ensure your provider maintains acceptable standards.

Is Print on Demand Profitable?

The print-on-demand industry continues to demonstrate strong growth potential, with market projections indicating sustained expansion through 2030. However, profitability depends on multiple factors, including niche selection, marketing effectiveness, and operational efficiency.

Average profit margins in print on demand typically range from 10-30%, depending on product categories and pricing strategies. T-shirts might yield a $5-10 profit per sale, while specialized products like custom artwork or professional accessories can yield $20-50 in margins or more.

Successful entrepreneurs often target monthly revenue goals of $1,000-5,000 within their first year, though results vary significantly based on commitment level and market conditions. Top performers may exceed $10,000 monthly by focusing on high-margin products and effective marketing systems.

Market saturation concerns exist in popular categories such as generic quote t-shirts and basic designs. However, opportunities remain abundant in specialized niches, personalized products, and trending topics that align with current cultural movements.

The integration of AI and automation technologies continues to reduce operational complexity while enabling more sophisticated design creation and market analysis. These tools level the playing field for individual entrepreneurs competing against larger companies.

Success depends on treating print-on-demand as a legitimate business requiring market research, quality control, and customer service excellence. Entrepreneurs who approach POD systematically, focus on their target audience, and maintain high standards continue to find profitable opportunities in this growing industry.

The print-on-demand business model offers exceptional opportunities for entrepreneurs seeking to start an online business with minimal upfront costs and inventory risks. While challenges exist around profit margins and provider dependency, the combination of technological advancement and market growth creates a favorable environment for dedicated entrepreneurs.

Success in print-on-demand requires strategic thinking, quality execution, and persistent marketing efforts. Focus on serving a clearly defined audience with high-quality products and excellent customer service to build a sustainable, profitable business that can generate passive income for years to come.

(678) 235-3464

To view the original version on Clash Graphics, visit: https://www.clashgraphics.com/printing-tips/what-is-print-on-demand/